2014 Annual and CSR Report

2014 Annual and CSR Report

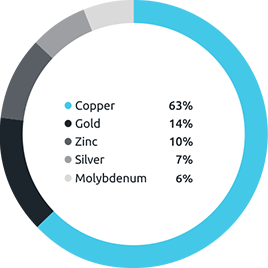

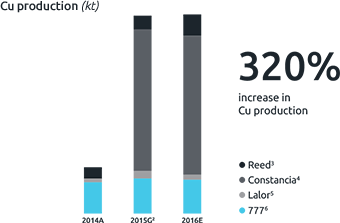

By the end of 2014, we had four producing mines, transforming Hudbay into a multinational company with unrivalled production growth, following several years of significant capital expenditure.

| Cu production (kt) | 2014A | 2015G | 2016E |

|---|---|---|---|

| Reed3 | 9 | 11 | 17 |

| Constancia4 | 0 | 113 | 111 |

| Lalor5 | 3 | 6 | 4 |

| 7776 | 25 | 28 | 27 |

| Zn production (kt) | 2014A | 2015G | 2016E |

|---|---|---|---|

| Reed3 | 4 | 0 | 0 |

| Constancia4 | 0 | 0 | 0 |

| Lalor5 | 42 | 67 | 71 |

| 7776 | 36 | 41 | 55 |

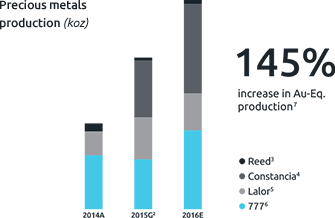

| Precious metals production (koz) |

2014A | 2015G | 2016E |

|---|---|---|---|

| Reed3 | 8 | 3 | 4 |

| Constancia4 | 0 | 57 | 90 |

| Lalor5 | 24 | 42 | 37 |

| 7776 | 54 | 50 | 79 |

| For the years ended December 31 | 2014 | 2013 |

|---|---|---|

| Production (contained metal in concentrate)* | ||

| Copper (000 tonnes) | 37.6 | 29.9 |

| Zinc (000 tonnes) | 82.5 | 86.5 |

| Gold (000 troy ounces) | 73.4 | 79.2 |

| Silver (000 troy ounces) | 745.9 | 772.5 |

* Metal reported in concentrate is prior to refining losses or deductions associated with smelter contract terms.

| ($ millions) For the years ended December 31 |

2014 | 2013 |

|---|---|---|

| Revenue | ||

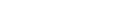

| Copper | $234.2 | $210.4 |

| Zinc | $267.1 | $219.1 |

| Gold | $87.5 | $99.5 |

| Silver | $14.2 | $14.4 |

| Other | $5.0 | $5.8 |

| Less: Treatment and refining charges | $(29.2) | $(19.9) |

| Less: Pre-production revenue | $(18.8) | $(12.5) |

| Revenue | $560.0 | $516.8 |

| Profit (loss) before tax | $11.5 | $(56.0) |

| Total assets | $5,627.5 | $3,844.0 |

| Equity attributable to owners of the Company | $2,446.7 | $1,635.6 |

| Cash and cash equivalents | $207.3 | $631.4 |

| Dividend paid per share | $0.02 | $0.11 |